1997: Taxpayer Relief Act, Roth IRA established. The Roth IRA is our biggest defense against the 49.95% and 40.7% Marginal Tax Humps, Tax Free income is always better than Taxable income during retirement, but these facts are often ignored by many of the investment advisors who offer you those “free dinners”. One of the primary benefits of using a Roth IRA is that you don’t pay income tax when you withdraw funds in retirement. These withdrawals are also not counted as part of the “basis” for the taxation of your Social Security benefits, and they are also not part of your MAGI, Modified Adjusted Gross Income, which is used to determine the cost of your Medicare premium. Traditional and Roth IRAs have contribution limits of $6,000 each year. If you are over 50, that limit is raised to $7,000. If you are single, this limit is phased out starting at $122,000 and you are ineligible at $137,000. The married filing jointly and widow(er) filers start the phase out at $193,000 and are ineligible at $203,000. There is however a backdoor for making Roth “contributions”. You can do a Roth Conversion! You basically move holdings or cash from your Traditional IRA to your Roth IRA and pre-pay the taxes as if you had merely withdrawn the funds. There is no Income Cap on the conversion of Traditional IRA funds to Roth IRA! If you are under 59 ½ you should pay your taxes from another source or the IRS will consider the Tax dollars taken from your IRA as an early withdrawal and charge you a 10% tax penalty! Don't let Magi catch you!No, Magi is not the name of your dog or the nickname for your mother in law! MAGI stands for your Modified Adjusted Gross Income which medicare uses to determine the size of your Medicare Part B premium. Medicare will look at your tax return from two year prior to determine your MAGI and your Medicare premium starting the year that you turn 65. You do not have to consider Medicare premiums and you can do as large a Roth Conversion as you want the year you turn 62 or younger, but you have to consider the extra cost of Medicare as part or your conversion costs starting the year you turn 63. Your current year's Medicare premiums are based on your Modified Adjusted Gross Income (MAGI) from your tax return two previous years ago!

After the age of 63, you need to consider your Tax Brackets and the cost of your Medicare Premiums when you are making the decision on how much of your traditional IRA to convert to Roth. The top end of the 2023 22% Federal Tax Bracket for a Single individual is $95,375 of “Taxable” income and the first increase in Medicare premiums happens at $97,000 of “Gross” income. There are three additional Medicare increases that occur before the $183,000 Gross income limit where the top end of the 24% Federal Tax Bracket is $182,100 of Taxable income. Calculating your taxes in April and being surprised at how much you owe for previous year is never a good idea. When you are retired and could be facing your Personal Tax Hump, waiting until April is a horrible idea. Your plan during retirement should be to calculate your Maximum Pre-Hump Taxable Income in January for the upcoming year and then keep track of that income level every time you get taxable income during the year. Then, at the end of each year, look at how much of a Roth Conversion you can do without going into your next tax bracket. Your "free dinner"!I’ve been to a number of those free dinners and I have purchased some of the Annuity products that they try to sell you. I am happy with my annuities and I often call them “one of my best horrible investments” that I have made for my retirement. One of the best horrible investments you can make!We like to call our annuities the best horrible investments we have made, but that terminology is incorrect. An Annuity is not an investment which grows and falls with the market. It is a contract that guarantees a fixed income stream for the rest of your life. There are many different kinds of annuities that you can purchase, and each annuity company has their own special ways of making theirs look like the best. Our annuities, like most, are divided into two parts; the annuity value side, and the cash value side. If you are looking for a great return on an investment, then you will probably feel like we do that the cash value side is a horrible investment! In our case, there was an immediate 8% bonus, but there is no guarantee that the cash value will continue to grow, and there are a number of early withdraw penalties if we ever say, "Give us our money back"! Also, since we included a form of life insurance, the cash value can actually decline due to "fees". The guaranteed lifetime annuity side is why we made the purchase. We received an immediate 8% bonus and the annuity value continues to grow by 7% per year until we start the annuity payments. The annuity payout percentage also grows by about 2% each year which makes the payout value grow by combined total of about 9%. When you start the payout, the lifetime income will be fixed for the rest of your life. Each yearly payout will be deducted from the cash value side. If you die before the cash value drops to zero, the remaining cash value will be a life insurance payment to your heirs. But again, even if the cash value does drop to zero your guaranteed income will continue for the rest of your life!

Let's look at a real life example! This chart illustrates the differences in buying a $100,000 Annuity at the age of 50 vs waiting until age 58 or 60 or 62. Looking at the age 62 line, holding the annuity for 12 years will give you an income of $1,054 a month for the rest of your life while buying it the same day that you start your payments will only give you $450 a month. The size of your annual payments grows the longer you wait to start your payments, and your cash value life insurance value does continue to grow while you wait, even though, as mentioned above, it does grow at a relatively small rate. Just remember, you are not buying an annuity for short term growth, you are buying it for Guaranteed Contractual Lifetime Income. Note: Most annuity companies do not allow you to split an annuity into multiple parts, start half of your payout at age 66 and the other half at age 70. For that reason, if you are considering one large Annuity, it will give you more flexability if you purchase a series of smaller Annuities. Beware of the Annuity Sour Spot!

Let’s take another look at the table that we saw on the “My Tax Rates” page that illustrated “Your Personal Sweet Spots”. If your personal Guaranteed Pension plus your Minimum Required IRA Distribution will already create taxable income in the 37K to 32K “Other” range on the second line of this table, then your Guaranteed 10K to 15K Annuity income will be taxed within your double Personal Tax Hump at 40.7% and maybe some at the 49.95% triple tax level. Don’t let the “Free Dinner” salesman merely sell you an Annuity, do the math before you purchase your Annuity. The salesman just wants to sell you his product, he doesn’t care anything about the taxes you might have to pay on that income when you start receiving it! If you, or your surviving spouse, is in this situation, consider doing a Roth Conversion and then purchase the Annuity within your Tax Free Roth account. Yes, if you pay the taxes from the converted funds, your Annuity will be 22% less, and so will the salesman’s commission, but you will avoid paying 40.7% taxes, or higher, on the Annuity income during retirement..  Most of the discussion so far has focused on single retired individuals. Now let’s turn our attention to some of the special situations faced by Married Couples. Next - The Marriage Penalty and the Widow's Penalty! |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

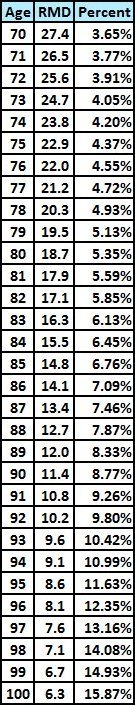

One of the

biggest problems that many of us have to plan for as we get older are the

Required Minimum Distributions that we are forced to take from our

taxable IRAs after we reach the age of 70. The size of our RMDs

can easily force us into our Personal Tax Hump and percentage we

are forced to withdraw each year increases as we get older.

One of the

biggest problems that many of us have to plan for as we get older are the

Required Minimum Distributions that we are forced to take from our

taxable IRAs after we reach the age of 70. The size of our RMDs

can easily force us into our Personal Tax Hump and percentage we

are forced to withdraw each year increases as we get older.