The Marriage PenaltyThe Economic Growth and Tax Relief Reconciliation Act of 2001 eliminate most of marriage penalties that existed in our tax laws prior to that time. The Income Tax Bracket for middle income married couples are now double those of a Single Individual and the Medicare premiums paid by retired married individuals are also based on double the income levels of single individuals. Unfortunately, the penalty still exists for the income levels defined in 1983 and 1993 for the taxation of our Social Security benefits! These are the images of the Social Security Marriage Penalty for 2020 and 2023. The top of each example displays the Tax Hump for a single individual while the bottom image displays the Tax Hump for a married couple with exactly twice the Social Security income. The Social Security increases between the 2020 and 2023 examples represents the results of the extremely high inflation rates in 2021 and 2022.

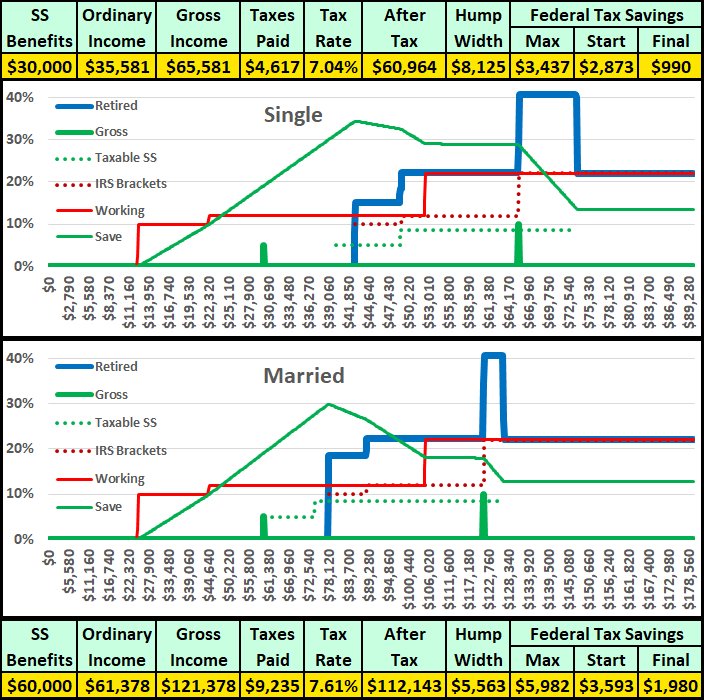

This is an example of the marginal tax hump for a single individual with a $30,000 Social Security benefit. This individual can also have an extra $35,121 of pre-hump taxable income, resulting in a 2019 after Federal tax net income of $60,578, a 6.98% overall tax rate. Their next $8,585 will be taxed at 40.7%. If two single individuals were living together as domestic partners, their combined income and taxes would merely be twice the size of each individual. Their pre-tax hump net income would be $121,156. The second image representing the marginal tax hump faced by the same couple if they decided to get married and file a joint return. The bottom scale is exactly doubled. Note how the dotted green Taxable SS line starts well before the start of their taxation. The SS taxation of each individual in the first graph starts at a Basis Income level of $25,000, a combined $50,000 for the domestic partners, while taxation for the married couple starts at only $32,000. This earlier start of SS taxation results in a pre-hump net income of only $111,373 for the married couple, a Marriage Penalty of almost $10,000. Note also that since the married couple is saving less tax dollars at lower income levels than the domestic partners, their tax hump is smaller because they have less savings to give back to the IRS! What Causes The Marriage Penalty?The primary cause of the Marriage Penalty is the starting positions for the taxability of your Social Security benefits. The calculation of the “basis” for this taxation is the same, basically half of your Social Security benefits plus your other taxable income. 50% taxability starts when the basis exceeds $25,000 for a single individual, which would double to $50,000 for domestic partners. But the 50% taxability starts at only $32,000 for a married couple, and 85% taxability starts at $44,000, which is still $6,000 less than the $50,000 combined start of the 50% taxability level for the domestic partners.  At the $50,000 taxable basis level $11,100 of the married couple’s Social Security is being taxed while none of the domestic partner’s benefits are taxable. Over the next $18,000 of income another $15,300 of the married couple’s benefits become taxable while only $9,000 of the domestic partner’s benefits become taxable. At this point the marriage penalty reaches its maximum where an additional $17,400 of the married couple’s benefits are being taxed. This $17,400 taxable penalty continues for variable amount of income based on the size of the Social Security benefits levels. If the total benefit levels of each couple are identical, the domestic couple will continue to increase their taxable benefits for another $20,471. So, basically, the married couple’s Social Security benefits are taxed at lower income levels. Their potential tax free income is $7,427 less, and their personal tax hump starts $9,731 before that of the domestic partners. Since this results in them saving less tax dollars at the lower income levels, the size of their personal hump is also smaller because they have less to give back to the IRS. At higher income levels, when everyone is paying their full hump taxes, everything basically evens out because at that point everyone is paying taxes on the same 85% of their Social Security Benefits. Married couples just pay it earlier. The only penalty that remains is that the additional over 65 standard deduction is only $1,300 for married individuals and $1,600 when you are single. The Widow(er) PenaltyIf you did not plan your inheritance properly, your surviving spouse could have the same income as you did as a married couple while being faced with higher tax rates because they will have to file the same income levels as a single individual instead of a married couple.

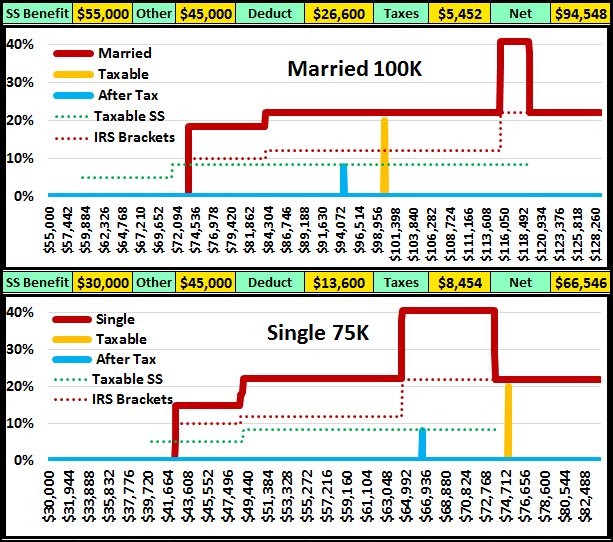

In this example we see a married couple with $25,000 and $30,000 Social Security benefits plus additional taxable income of $45,000 from pensions, annuities, IRA withdrawals, etc. Their total annual married income is $100,000 and the top graph shows that their income level is more than $15,000 below their personal 40.7% Marginal Tax Hump. Their federal taxes will be $5,452. When one of them passes away, the survivor will lose the $25,000 SSB and keep the larger SSB. Assuming that all of their pensions, annuities and other taxable income sources continue for the survivor, the additional income will remain at $45,000. The Widow’s annual gross income will drop to $75,000 and the lower graph shows that her income level will be higher than the top end of her personal 40.7% tax hump created as a single individual vs. a married couple. Her federal taxes will be $8,454! The Widow is not only losing the $25,000 SSB, but also has to pay an additional $3,002 in taxes! Can this be avoided?One of the things they might have considered would be to calculate their taxes in December each year, then do a Roth Conversion that will maximize their 22.2% Marginal Federal Tax Bracket. If the widow could reduce her other taxable income by $11,000 each year she would save $4,130 in taxes. This could be done with an annual withdraw from a tax free Roth account of $6,870 ($11,000 minus $4,130). If this couple did have an annuity and they did their retirement planning early, they could have bought their annuity within their Roth IRA so their guaranteed income would be tax free. If your inheritance to each other passes as taxable income the immediate and lifelong tax penalties could be substantial. Even if the taxes are not immediate as your individual IRA is combined, sort of tax free now, with your spouses IRA, the larger combined IRA will have a much larger RMD, Required Minimum Distribution, for the remainder of the surviving spouses lifetime.  Now that we have discussed the many of the financial topics that you could face during your retirement, let's take one last review of those topics before we introduce you to our downloadable spreadsheet. Next - A quick review of what we have covered so far! |

|||||||||||||||||||||||||||||||||||||||||||||

In each example, the married scale is exactly double the single scale so that it replesents income per person. Take special note of how the

Taxable Social

Security line for the Married couple starts earlier than the taxable line for the single individual, in fact, it even jumps to 85 cents per dollar before taxation starts. So, the married couples taxes start earlier and at a higher rate. Their pre-hump allowed extra income is lower, so their after tax income is less than double that of a single individual.

In each example, the married scale is exactly double the single scale so that it replesents income per person. Take special note of how the

Taxable Social

Security line for the Married couple starts earlier than the taxable line for the single individual, in fact, it even jumps to 85 cents per dollar before taxation starts. So, the married couples taxes start earlier and at a higher rate. Their pre-hump allowed extra income is lower, so their after tax income is less than double that of a single individual.