|

Where will your money come from?

Income during retirement comes in many forms; Social Security,

Pensions, Annuities, IRAs, Roth, Investments, etc. Some of your

income is Guaranteed and some is subject to Market Risk.

Some of it is Taxable while some is Tax Free. Planning for the

proper balance of these income sources can take a lot of

pre-retirement planning.

| Tax Delayed |

Max Taxable Income |

Tax Free |

|---|

Social

Security |

Long Term Capital

Gains & Dividends |

Guaranteed |

Market Risk |

Guaranteed |

|---|

| Pensions | Annuities | IRA RMD | Other |

Roth | Annuities |

|---|

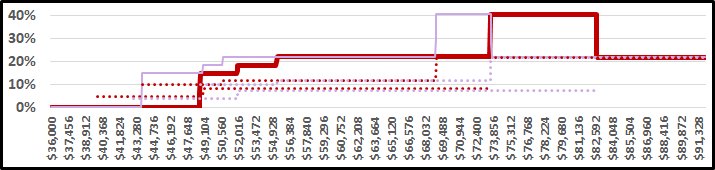

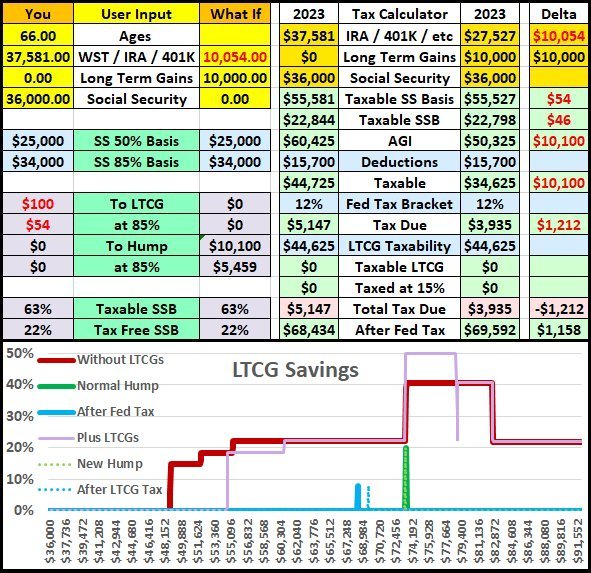

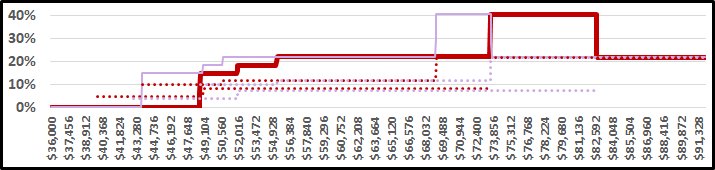

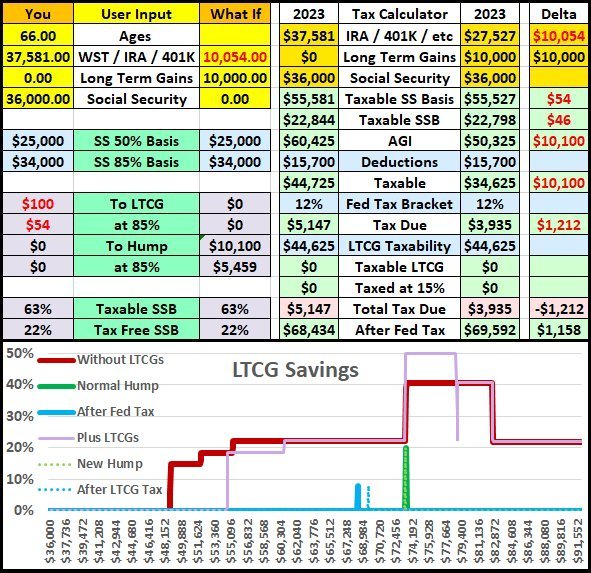

What is your maximum taxable income before entering

Your Personal Tax Hump?

|

Tax Delayed Income |

Social Security

Your personal sweet spots and the size of your personal tax hump are

defined by your personal Social Security benefit and your marital

status.

Your personal sweet spots and the size of your personal tax hump are

defined by your personal Social Security benefit and your marital

status.

Single

SSB | Max

Tax Free |

Max

Pre-Hump | Hump

Size |

|---|

| $20,000 | $13,850 |

$37,418 |

$1,287 |

|---|

| $30,000 | $12,567 |

$35,121 |

$8,584 |

|---|

| $40,000 | $10,900 |

$32,824 |

$15,881 |

|---|

|

Married

SSB | Max

Tax Free |

Max

Pre-Hump | Hump

Size |

|---|

| $60,000 | $17,784 |

$60,458 |

$6,483 |

|---|

| $70,000 | $15,487 |

$58,162 |

$13,779 |

|---|

| $80,000 | $13,190 |

$55,864 |

$21,077 |

|---|

|

There are two personal sweet spots, the taxable income level where

you pay zero taxes and the taxable income level just before your

personal tax hump starts.

|

Long Term Capital Gains

Long Term Capital Gains are also tax delayed income so they do increase

the amount of tax free income you can create but they do not significantly

change the width or position of your personal tax hump.

The Government's Tax Math for this example is relatively complex, BUT, all you really need to know is that if you can also have some Long Term Capital Gains, and you can keep them Tax Free, you will save even more tax dollars which will improve your personal retirement lifestyle!

The Government's Tax Math for this example is relatively complex, BUT, all you really need to know is that if you can also have some Long Term Capital Gains, and you can keep them Tax Free, you will save even more tax dollars which will improve your personal retirement lifestyle!

|

|

Maximum Taxable Income |

Guaranteed |

Pension

A pension is basically a Lifetime Contract. You will

receive a fixed monthly income for the rest of your life, and some

pensions also included cost of living increases!

|

Annuity

In many ways, an Annuity could be considered a self-funded Pension. It is a

CONTRACT with an insurance company and the payments are

guaranteed for life and there is no Stock Market Risk. If your

Annuity was purchased with untaxed funds from an IRA, your entire annuity

income will be taxable. If it was purchased with after-tax funds, taxation

of your annuity income will be determined by an exclusion ratio. If it was

purchased with Roth IRA funds, your annuity income will be completely tax

free.

|

Market Risk |

401Ks and IRAs

Pensions today are being replaced by 401Ks and IRAs. These are merely

different methods of saving money for retirement, but there is NO CONTRACT

and when the money runs out, the income stops, and stock market volatility

and taxes can play significant roles in how long your savings will last.

|

Required Minimum Distributions (RMDs)

When you reach age 70½, you are required to start withdrawing a certain

amount of money from your IRAs and 401Ks each year. The percentage that

you must withdraw increases each year which could eventually push you

into your Personal Tax Hump!

|

Other Taxable Income

There are many other sources of taxable income durings retirement; part

time jobs, pension increases, sale of posessioins, etc. Just be careful

that none of this income will be taxed at 40.7% or higher!

|

Tax Free |

Roth

Your Roth account is your biggest defense against Your Personal Tax Hump.

Start doing Roth Conversions as soon as possible and don't forget to create

Back Door Contributions by paying your taxes from other funds, not

from the sale of the converted assets.

Note: If you are under 59 ½ and you pay the taxes from the converted funds, the

IRS will consider the Tax dollars taken from your IRA as an early withdrawal and

charge you a 10% tax penalty!

|

Guaranteed |

Annuity

Annuity income is normally taxable, but it will be Tax Free if you purchase

your Annuity within your Roth Account!

|

Inflation

To see the results of inflation on the Personal Sweet Spots that were create in the

Tax Delayed Income

section above, we increased the 2019 tax brackets,

deductions, and Social Security benefit level by 10% and used the spreadsheet

that is downloadable for you at the end of this discussion to find

the inflated max taxable and hump size values.

| Single | SSB | 22% Tax Bracket |

Max Pre-Hump | End of Hump |

Hump Size |

|---|

| 2019 | $30,000 | $39,475 | $3,947.50 |

$35,121 | $2,193 |

$43,705 | $1,500 | $8,584 |

($693) |

|---|

| +10% | $33,000 | $43,422 | $37,314 |

$45,201 | $7,891 |

|---|

In the previous table larger SSB levels decreased our pre-hump taxable income level.

In this example it actually increased our pre-hump taxable income level because

the start of the 22% tax bracket which is also the start of the Tax Hump also increased

by 10%. The pre-hump max income level only increased by 6.24%, not 10%, because the taxability

factors for our Social Security benefits that were established in 1983 and 1993

were specifically designed not to increase with inflation. It should also be noted

that the size of the Tax Hump decreased by a small amount.

|

Caution! Yes it is true that Married

couples can have more taxable income than Single

individuals, but they should also consider what will happen

to their surviving spouse. If their additional income is

Guaranteed or Required IRA RMDs, as this income is

transferred to the surviving spouse, it could force the

surviving spouse into their Personal Tax Hump which

could cost them thousands of extra tax dollars each year.

|

Married couples should also look at the Single Max

Taxable income table when planning their retirement income

sources. The surviving spouse will inherit their larger Social

Security benefit and, assuming that all of their combined

Guaranteed income will continue for the survivor, the

Single Max Pre-Hump income level has to be considered.

They should start doing maximum 22.2% Roth Conversions

every year if a large portion of their Taxable income is

coming from required IRA RMDs.

During retirement, where your income is

coming from is almost as important as how much income you will

receive. In some cases it can actually be more important, so

let's start looking at those income sources!

|

|